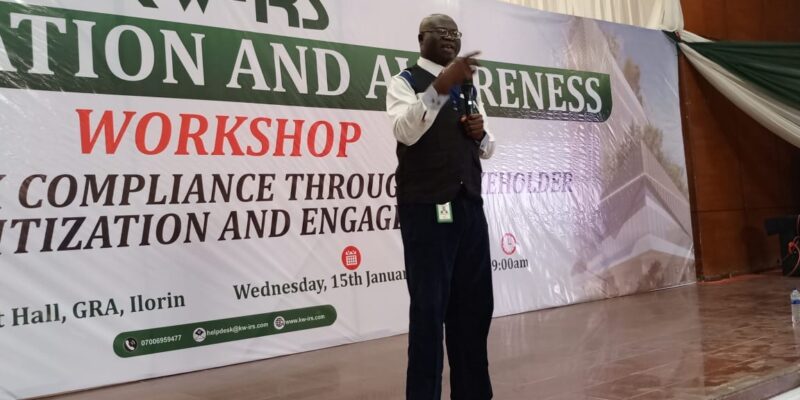

The Kwara State Internal Revenue Service (KW-IRS) on Wednesday organised one-day sensitization programmes to reawaken citizens’ responsibility in tax payment compliance and enlighten stakeholders on new tax reforms.

The programmes which was held at the Banquet hall of the government house, Ilorin had in attendance, representatives of private industries, small and medium business owners, professional bodies, Ministries Departments and Agencies (MDAs), Civil Society Organizations and individual taxpayers.

Declaring the event open, the Executive Chairman of the Agency, Shade Omoniyi said the workshop became necessary due to the agency’s observation of a lack of adequate information and knowledge on the part of the taxpayers which has been hindering the agency’s performance.

“Taxation, as we all know, is the lifeblood of any economy. It is through the faithful payment of taxes that the government can provide critical infrastructure, quality education, healthcare, and other essential public services.

“However, tax compliance remains a significant hurdle. Addressing this challenge requires deliberate strategies, collaboration, and continuous stakeholder dialogue.

“Today’s program has been thoughtfully designed to address some of the pressing issues surrounding tax compliance and to provide practical insights for all stakeholders,” she said.

Cross-section of the participants at the workshop. 15th January, 2025.

Five papers were presented on the theme of the programme tagged “Enhancing tax compliance through stakeholders sensitization and engagement”

The papers presented include; ‘Harmonized bill and other taxes collectables by the service’ delivered by the agency Director of MDAs, Omotayo Ayinla. ‘Practical guide on filling of annual returns for corporate organizations and individuals’ delivered by HOD Tax Audit, Mohammed Rufai. ‘Payment options and processes’ by HOD Corporate Tax, Kuburat Yinusa. ‘Withholding tax regulation 2024 and proposed tax reform’ delivered by HOD tax assessment, Abdullahi Gegele.

Delivering a paper on the implication of non-compliance, Muhammed Audu, HOD Corporate Planning said failure to pay tax, underreporting income, non-filling annual returns, overstating deductions and not remitting within record time attract penalties such as N50,000 for individuals and N500,000 for Corporate organization or six months imprisonment.

Participants were given time to ask questions with corresponding answers and they were put through practical ways of filling tax on the website of the agency noting that manual tax filling is no longer allowed.

Comments